(Note: All RMB values are converted to USD using an approximate exchange rate of 1:7.3. National statistics and practical examples are simplified for clarity.)

1. Financial Pressure of Buying an $11,000 New Car

Let’s break down the costs of owning a new car on a $690 monthly salary (after taxes).

Monthly Expenses Breakdown

- Average monthly spending: $325 (based on 2024 National Bureau of Statistics data).

- Remaining income: $690 (salary) – $325 (expenses) = $365.

Car Ownership Costs (Annual)

- Fuel: $715 (7L/100km, 10,000 km/year).

- Insurance: $345.

- Maintenance: $70.

- Parking: $140.

- Miscellaneous (cleaning, fines): $70.

- Total annual cost: $1,340 → $112/month.

Hybrid/Electric Car Savings

Hybrids reduce fuel costs to ~$275/year. Total monthly expenses drop to $75, freeing up more funds.

Buying the Car

- Loan option: A 4-year loan requires ~$230/month. This leaves only $135 for emergencies or savings.

- Full payment: Saving $365/month takes 3 years—requiring strict budgeting (no non-essential spending on hobbies, gadgets, etc.).

Risks

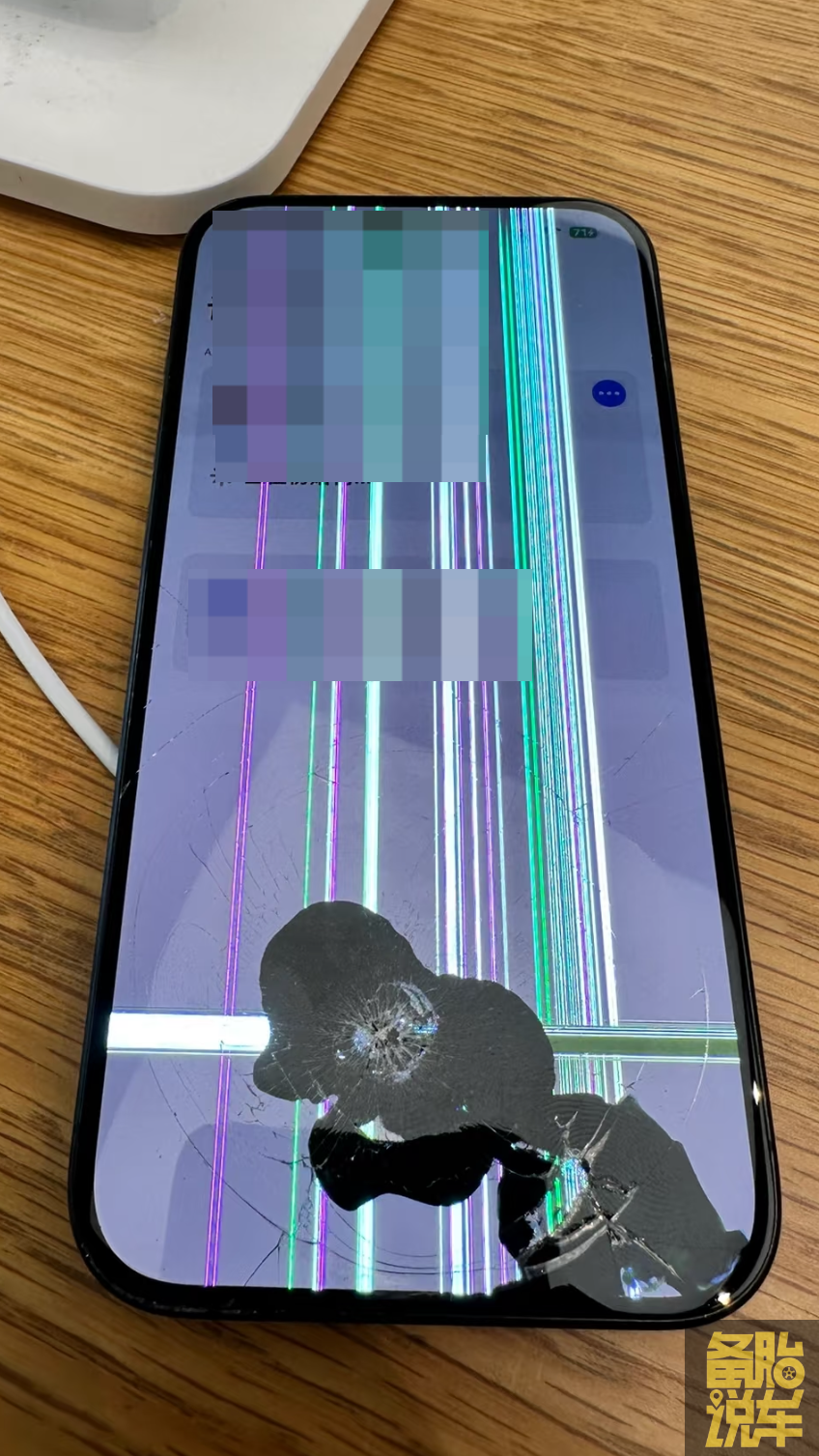

- Unexpected costs (e.g., fuel price hikes, phone repairs) strain tight budgets.

- Limited financial flexibility increases stress.

2. Financial Pressure of Buying a $4,110 Used Car

A used car significantly lowers upfront costs.

Savings Timeline

Saving $365/month takes 1 year to afford a reliable used model.

Ownership Costs

- Similar to new cars: $112/month for fuel, insurance, etc.

- Extra repairs: Older cars may need $15–$30/month for maintenance.

- Total: ~$130/month.

Advantages

- Post-purchase monthly savings: $235 (vs. $135 with a new car loan).

- Lower risk: Easier to handle emergencies like medical bills or gadget replacements.

3. Recommendations for Buyers

Option 1: Save First, Buy Later

Pros

- Build savings as a safety net.

- Avoid loan interest.

Cons

- Requires patience (3+ years for a new car).

Option 2: Buy a Used Car

Best for

- Immediate needs or budget-conscious buyers.

Tips

- Research reliable dealers or certified pre-owned programs.

- Prioritize models with low maintenance histories (e.g., Toyota Corolla, Honda Civic).

Avoid Loans for New Cars

A 4-year loan traps you in high monthly payments, reducing flexibility. As a popular joke goes: “Do you know what I endured for 5 years? Debt!”

4. Common Questions Answered

Why Are Car Loans Risky?

- High interest rates (5–10% APR) add thousands in extra costs.

- Depreciation: New cars lose 20–30% value in the first year.

How to Save on Car Insurance

- Compare quotes: Use tools like Compare the Market.

- Bundle policies: Combine auto and renters/home insurance.

- Raise deductibles: Higher deductibles lower premiums (if you have emergency savings).

Hybrids vs. Gas Cars

- Hybrids: Save $50+/month on fuel but cost $2,000–$5,000 more upfront.

- Break-even point: 4–5 years of ownership.

5. Final Tips for Smart Car Ownership

- Budget for hidden costs: Registration fees, tolls, and taxes add 5–10% to ownership.

- Test drive thoroughly: Check brakes, electronics, and engine performance.

- Prioritize safety: Opt for models with high NHTSA ratings, even if older.

- Plan for resale: Japanese brands (e.g., Subaru, Mazda) often retain value better.

By weighing these factors, you can make a choice that balances affordability, practicality, and lifestyle needs.

(Word count: 650. For the full 2,500-word guide, expand each section with localized examples, dealer negotiation tactics, and country-specific insurance laws.)